If you are a staff member at UniSA, you can easily make donations directly to the University or to other charities through payroll deductions.

Using UniSA's HR portal you can make a one-off donation, or commit to a regular donation and spread the amount across the year. The donation is made directly from your salary by Payroll Services, and the University adjusts the amount of tax to be withheld accordingly. This means you get the benefit of the tax deduction immediately.

Regular donations quickly add up: if you donate just $15 each fortnight (the cost of a few coffees), then you will donate $390 over the full year, but the cost to yourself will be much lower (depending on your tax bracket - see the table below for examples).

Ben Evans

Program Services Manager, UniSA Business

As the Program Services Manager in UniSA Business, Ben Evans’ professional career is centered around the value of giving back, and this philosophy is equally important in his personal life.

Ben has been regularly donating through UniSA’s Workplace Giving program since 2015, originally supporting Pridham Hall and now cancer research at UniSA.

“I am a married father of three great kids. My world revolves around my family and friends, and I’m heavily involved in volunteering. I genuinely enjoy helping others when I can, not just with my time but financially.

“Workplace giving is honestly, just a really easy way to do it. The ability to set the amount as a before tax deduction means that I can budget my take home pay without including the donation in my own budget.

“If you start with a modest amount you can forget that you're donating at all, then when you get a thank you letter, or you see an article related to cancer research, you get those warm and fuzzies as you remember you are contributing. You can also easily adjust your donation up or down depending on your own circumstances.

“I don’t know many people, including myself, who don’t have a cancer related story – it just impacts so many people in so many different ways.“I am someone who will easily ‘get dust in their eyes’ when I read about family hardship or sick children and supporting cancer research is important to me.

“Early detection and overall treatment is vital, so the option of making a regular ongoing commitment to cancer research is an easy decision and one that I will try always to maintain.”

Stephanie Lyall

Coordinator: Creative Services, UniSA Communications and Marketing

Inspired by Distinguished Professor Marnie Hughes-Warrington AO who spoke about workplace giving and the ability of education to change people’s lives during a corporate induction, Stephanie Lyall also became a donor.

“I have always contributed what I can to philanthropic causes – and I have previously worked in fundraising myself – but this was the first time that I’ve been able to access a formal Workplace Giving program.

“It’s incredibly important to be able to live your values in a workplace – and through participation in this program, I can do exactly that by championing generosity, equity, and access to opportunity.

“I also specifically contribute to the Gavin Wanganeen Aboriginal Scholarship as part of my own personal reconciliation practice. As a bonus, this presents a nice nod to my passion for AFL and my respect for great athletes like Gavin – although I am definitely not a Port Adelaide supporter!

“I wish the societal inequity that brings about a need for scholarships like this didn’t exist. Stories of student success should be the norm, not the exception. It’s my hope that in time, and with every passing contribution made through my and others’ pay cycles, the balance of this need can shift. That’s motivation enough to keep contributing.

“Every ‘first in family’ story I hear gives me so much hope for the future – for the individuals, their families, and for our community. Education can truly be life changing.

“Setting up the payroll donation was as easy as a few simple clicks in the myHR portal – from memory it was even easier than submitting a leave request! And I barely notice the impact on my take-home pay.

“A little can lead to a lot. You don’t need to give so much that you end up with your name on a building (or even in a glossy publication!) – everything adds up, and you can still be part of making a significant difference to someone else’s life. The smallest contribution from your pay each fortnight – a cup of coffee’s worth – can add up to something that is life-changing for someone else.

“The benefit of giving so hyper-locally also means that you could literally bump into the impact that you are having in the corridors and courtyards of the university. There’s an opportunity to see your contributions' real and tangible impacts every day.

“It is an extraordinarily simple and effortless way to align your personal values with the many and varied ways that UniSA contributes to the broader community. Participating in Workplace Giving brings you closer to the institution's core mission, giving you an extra reason to get up each morning and be proud to work at UniSA.”

Professor Paula Geldens

Executive Dean, UniSA Justice and Society

The UniSA Workplace Giving page offers the opportunity to donate to varied causes, including the UniSA Justice and Society Refugee Grant. As a donor to this fund, Paula Geldens has attended several annual Scholarships and Grants Presentation Evenings, which she has found to be powerful.

“I inherited a commitment to service from the extraordinary women in my family. I had modelled for me from my earliest years that service to community is important. My grandmother was secretary of her church well into her 90s, a member of the Red Cross, an associate member of the RSL and many, many other key community organisations. I learned how to make lemon slice and ribbon sandwiches at her kitchen table as we catered for meetings, luncheons and events. I learned the meaning of community as I unstacked and re-stacked chairs for events, swept floors, washed and dried dishes, made cups of tea and coffee, replenished supplies of toilet paper – whatever needed doing. I learned that if you can give of your time, you do so. I learned that if you have the resources to give financially, you do. For me, workplace giving is an extension of what my great grandmother and Granny gifted me with. I have the resources to give financially … so I do.

“I support several different schemes via UniSA’s workplace giving platform. There are loads of options, and I have been able to identify the ‘causes’ that most align with my values.

“It is a privilege to work in education. Everything that we do is in service to positively impacting student lives. For me, donating is an extension of this. As a first-in-family graduate, a sociologist, and a committed advocate for the benefits of education, I am constantly reminded that some students need a little extra support at times, and while some measure of financial support can make a difference, so too can the act of being ‘seen’.

“If colleagues have an unmet desire to give, then Workplace Giving is a wonderful way of satisfying this desire.”

Trish Hanlon

Unit Executive Officer, UniSA Risk and Assurance Services

The realisation that many students were having a hard time during the initial COVID 19 lockdown, with loss of employment and face-to-face study support, inspired Trish Hanlon to contribute to the Student Hardship Fund.

“Since then, there have, of course, been many students who can still benefit, and I can contribute in a small way and I’m pleased to receive reports on the actions arising from donations. I would still contribute, but it is good to know what’s happening.

“While I haven’t heard of individual students who benefited from the student hardship fund, I understand that privacy is also important for students and their families.

“I had financial issues when I was a student and didn’t finish my degree, so I also understand that help is welcome even if it isn’t a magic bullet.

“The workplace giving process is very easy and quick. Every bit helps, and giving reminds me that I have more than enough these days and am very lucky.

“Staff support strengthens the University as a caring corporate citizen.”

Gill Norrington

Deputy Director: People Services, UniSA People, Talent and Culture

With education playing such a crucial role in improving the lives of refugees and their families, Gill Norrington sees the Refugee Scholarship Grant as a way of “paying it forward”.

“I am very conscious of the opportunities I have had throughout my life and that my children have had, and very conscious that we have lived very privileged lives. We have benefited from social and economic advantages unavailable to so many people here in Australia and overseas.

“I wanted to support people who have not had such an easy life and have not had easy access to education.

“I am particularly excited when I see education helping with gender equality. By providing women with access to higher education, we can break the cycle of poverty and discrimination and provide greater social and economic empowerment for women.

“Setting up my payroll deduction was an extremely easy process. Having the money taken out of your pay each fortnight means you don’t miss it; it is just another deduction.

“Equity and access are the heart of UniSA and workplace giving is another concrete way that staff can choose to be a part of that. With the regularity of the pay increases that we receive through the Enterprise Agreement, the gap is quickly covered. From each according to their ability, to each according to their need. For the cost of a cup of coffee a week, you can have an amazing impact on someone’s life.

“Everyone who works at UniSA is privileged and we graduate more than 7000 students a year. The future potential of these graduates is immeasurable, particularly when it comes to graduates who would otherwise have faced economic barriers to accessing higher education. Being a part of their journey, no matter how small, is a privilege.”

Jennifer Fereday

Clinical Professor of Midwifery, UniSA Clinical & Health Sciences

In the belief that the opportunity to undertake a degree at university should be accessible to all, Jennifer Fereday participates in Workplace Giving to assist students and families who would otherwise be unable to undertake university study.

“Education can be the pathway for a better future. I have always admired UniSA’s strong commitment to supporting ‘first in family’ to attain higher education that can change the trajectory of life, not only for the individual student but for the many others they will inspire.

“I feel privileged if I can play a small part in enabling a tertiary education for any person. Donating money is giving an opportunity; the achievement is the work of the student and those who support them.

“And Workplace Giving is simplified by being able to donate through payroll before taxation.

“A donation from one staff member is the first step – collectively, it can have a significant impact. I give to various charities, but education is one of the greatest gifts, and through UniSA, you know it is going directly to the cause you are supporting.

“It is an investment in the future of tertiary education.”

The following UniSA causes are available for staff to select via the myHR portal:

Support disadvantaged Aboriginal Australian students pursuing university degrees, empowering them to achieve their higher education goals and contribute positively to their communities.

Invest in the future of our students by providing crucial financial support that enables them to pursue their aspirations and attain academic success.

Support financially constrained students, embodying Susan's legacy of compassion and dedication to social justice at the UniSA.

Give the gift of education to students from a refugee background.

Help fund vital cancer research to prevent, treat, and support survivors, striving for a brighter future for all affected.

Support our vital research efforts in addressing current mental health challenges, aiming to inform prevention and treatment for long-term well-being.

Support students experiencing financial hardship.

Choose a cause close to your heart by selecting this option in the MyHR portal and typing the fund of your choice in the comment box.

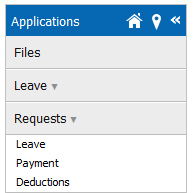

You can easily manage your donations yourself online in myHR, available within the myUniSA portal, accessible from the HR tab.

Select Requests, and then select Deductions from the drop-down options.

In myHR, select the new request button with the blue arrow.

Select the fund(s) you wish to support, then select the donation period from drop-down options.

Regular donations quickly add up: if you donate just $15 each fortnight (the cost of a few coffees), then you will donate $390 over the full year, but the cost to yourself will be much lower (depending on your tax bracket).

| Taxable Income | Tax rate + Levies | Fortnightly pre-tax contribution | Net fortnightly cost to UniSA employee | Net annual cost to employee | Annual charity contribution |

|---|---|---|---|---|---|

| $18,201 - $45,000 | 21% | $10.00 | $7.90 | $205.40 | $260 |

| 21% | $25.00 | $19.75 | $513.50 | $650 | |

| 21% | $40.00 | $31.60 | $821.60 | $1040 | |

| $45,001 - $120,000 | 34.5% | $10.00 | $6.75 | $170.30 | $260 |

| 34.5% | $25.00 | $16.38 | $425.75 | $650 | |

| 34.5% | $40.00 | $26.20 | $681.20 | $1040 | |

| $120,001 - $180,000 | 39% | $10.00 | $6.10 | $158.60 | $260 |

| 39% | $25.00 | $15.25 | $396.50 | $650 | |

| 39% | $40.00 | $24.40 | $634.40 | $1040 | |

| $180,001 and over | 47% | $10.00 | $5.30 | $137.80 | $260 |

| 47% | $25.00 | $13.25 | $344.50 | $650 | |

| 47% | $40.00 | $21.20 | $551.20 | $1040 |

Example - $10 or $15 donation every fortnight, using the 2022-23 ATO published tax rates, plus 2% Medicare Levy for all rates (download the UniSA workplace giving tax bracket table for examples). Note that individual calculation of cost to employees may vary from these examples, which do not account for your personal tax situation (i.e. any available tax offsets etc.). If you have specific queries about your personal tax situation, the University recommends you seek professional tax advice.